Automatically generate and send our tax receipts on all your forms.

If you're a registered charity, you can use Zeffy to issue both your online and offline tax receipts, keeping track of them all in the same place. You can also issue split tax (partial) receipts for your ticketing forms (events, memberships, store, etc).

Step 1: Make sure your account is set up correctly!

- Log into your Zeffy dashboard on a computer.

- Click on the little arrow next to your name at the top lefthand corner of your dashboard.

- Click on "Settings".

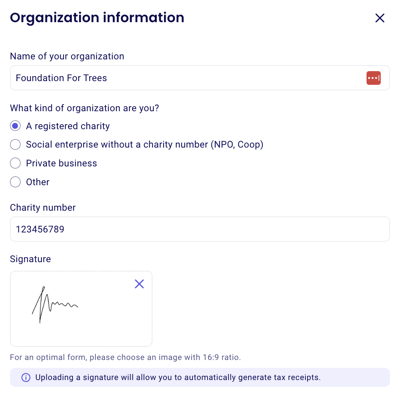

- 1️⃣ Click on "Organization Information": Make sure you have selected that you are a registered charity. Enter your charity number and upload the signature of someone who can represent your nonprofit.

- 2️⃣ Click on "Visual identity": Make sure to upload a logo.

💡 The signature and logo are mandatory to generate tax receipts in your account.

🇺🇸 USA Accounts:

- 1️⃣ Click on "Organization Information": Make sure you have selected that you are a 501(c)(3) organization. Enter your EIN and save your changes.

- 2️⃣ Click on "Visual identity": Make sure to upload a logo.

💡 The EIN number and logo are mandatory to generate tax receipts in your account.

Step 2: Turning on automatic tax receipt generation

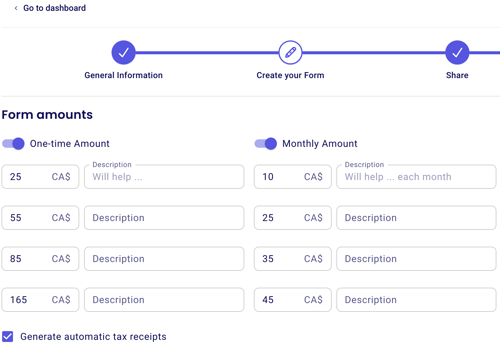

Turning on automatic tax receipt generation for donation forms or P2P campaigns

- Go to "my forms" and click on "Edit" to the right of the form for which you want to activate automatic tax receipts. (If you don't have a form yet, you can create one)

- In the "Create Your Form" section of your donation form, check the box to "Generate automatic tax receipts".

- Click "Save" in the top right-hand corner. You're all set! Tax receipts will be automatically generated every time you receive a donation on this form. It will also automatically be sent to donors in their confirmation email.

- To edit your confirmation email, take a look at our documentation here.

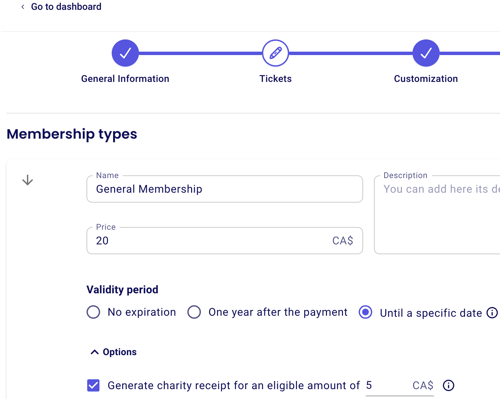

Turning on automatic partial tax receipts for memberships, events, raffles and online stores

- Go to "my forms" and click on "Edit" to the right of the form for which you want to activate automatic tax receipts. (If you don't have a form yet, you can create one)

- In the "Tickets" section of your ticketing form, underneath each ticket, you will see the word "Options". Click on "Options".

- Check the option to generate a charity receipt. You can now select the amount that is eligible for a tax receipt.

- Click "Save" in the top right-hand corner. You're all set! Tax receipts will be automatically generated and sent to donors when they make a purchase through this form.

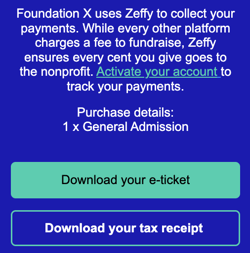

How will my donor receive this receipt?

Each time a transaction is carried out on Zeffy, your buyer automatically receives a confirmation e-mail. If you have activated the automatic generation of a tax receipt, this receipt will be included in the confirmation e-mail sent automatically.

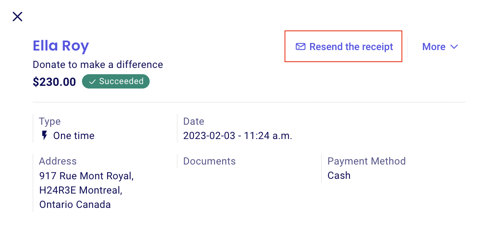

Resend the confirmation e-mail

You can resend the confirmation e-mail, which will include the ticket or tax receipt (if applicable). You can even resend it to another e-mail address if your donor has made a typo.

Under "my payments", click on the payment in question and a page will open to the right. Click on the "resend receipt" option in the top right-hand corner.

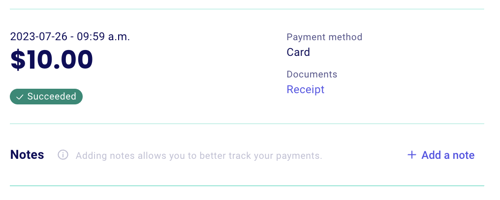

Download the receipt

You can also download the receipt from your dashboard. Under "my payments," click on the payment in question, and a page will open towards the right.

The receipt will be attached under "receipt."